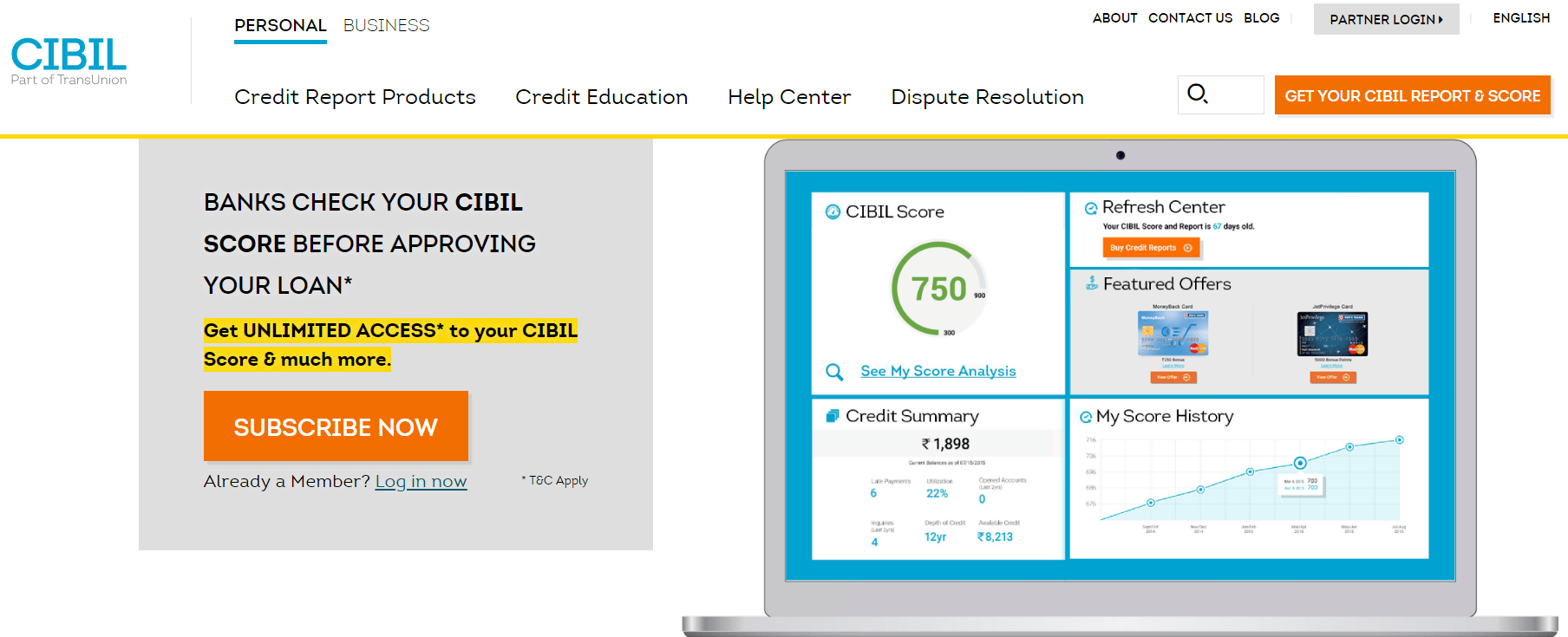

If you are planning to take out a loan any time soon, stop! Before you file in your application requesting a loan, check your credit score. A credit score is a three-digit number used by lenders as a guarantee of repayment on your behalf. Based on this score, the lender decides whether to give you a loan and at what interest. The higher your score is, the higher are the chances of you getting better borrowing opportunities. The credit score is made up of a credit report formulated on your credit history. It involves the details of your previous investments and credits, along with its repayment schedule. It is easy to score a high credit score by following simple steps. However, delay or failure in fulfillment of these ‘simple’ steps can lead to a low score. A good credit score can help you qualify for premium rewards credit cards and low-interest loans. However, this process takes time. This journey towards improving your credit score is not a cakewalk. You can get started by checking your credit score to see where you currently stand. Most credit scores – including the CIBIL score – operate within the range of 300 to 850. The credit tiers generally look like this:

10 Ways to Improve your Credit Score

What influences your credit score? The credit score is based on your credit report, which includes the following criteria of evaluation:

Payment History: Your payment history includes the records of repayment of credit in any form from credit card accounts to personal loans. If the previous payments are late, less or irregular, chances of you earning a good credit score will diminish. Amount of Debt: Debt is a major contributor in bringing down a credit score. It thus also contributes majorly in evaluating the credit score. Age of Accounts: The amount of data provided to the bureau also affects your credit score. New accounts will generate a low credit score as compared to old credit accounts. You need to give time to the account so that it grows enough to generate a good credit score. Account Mix: It is always prescribed to have a diversified financial portfolio while applying for credit. This indicates that you, as a borrower, can handle a diverse set of credit like credit cards, loans, et cetera. History of Credit Applications: If you apply for extremely less or high credit options, for instance, credit cards – you immediately come under the suspicion radar of creditors. It is important to time your applications

After analyzing your current position and growth potential, use the following tips to begin building better credit.

1.Recheck existing credit report

Since your credit history is fed in a credit report, which is further used to extract a credit score, you must analyze it carefully. Review previous loans, borrowings, investments, EMI’s, and their schedule of repayment. It is susceptible to errors, so check and correct them as soon as possible. To tally your credit report, use the following questions to spot any possible errors:

Is all of your personal information accurate without any misinformation or misspelling? Are all of your credit accounts being reported? Are there any late or missed payments listed that you remember making on time? Are there any accounts or applications for credit you don’t recognize? Are there any items from decades ago still appearing on your report?

2.Correct the errors

Your credit score can dip even due to minor errors like misinformation, misspelled name, or missing information. This could also mean that your identity has been stolen. These minor errors can also indicate suspicion on your front. Hence it is necessary to pinpoint these errors and correct them by approaching CIBIL.

3.Create a plan

While beginning to improve your credit score, you should aim to keep your credit card balances on the lower end in addition to any other revolving credit you may have. Start by paying down your debt rather than moving it around. Do not close any unused credit cards because it is not the “quick fix” you are looking for to improve your score. Eventually, keep in mind that you do not open any new credit accounts like a new loan or a new credit card that you do not need just because you are looking to maximize the available credit you have.

4.Pay your bills on time

What catches the eye of a lender whilst reviewing your credit report is how reliably you pay your bills. This is because it is used as a baseline that predicts your future performance. This can either make or break your credit report. Late payments or paying less than what you agreed upon can negatively affect this score. Paying your bills does not only include credit card bills or repayment of loans but also rent, utilities, phone bills, and so on. You can take care of timely payments by setting reminders, making a schedule, or using other available resources.

5.Build a strong credit age

To improve your credit score, you need to have a good amount of elements to make up a credit history. If you have a short credit history, there is not much you can do but wait. You can become an authorized user of a card owned by a family member, but it has its own cons. Therefore, wait it out. A good average age of credit history is five years and above. The longer your positive history is, the higher your credit score will be. Always remember that in case you do not have a history, it will be estimated from three to six months from the beginning date. If you have any pending debt, pay it off immediately instead of repeatedly transferring it to new accounts. Here, you need to contact the debt collector listed on your credit report to see if they would be willing to stop reporting the debt to each major credit bureau (CIBIL in India) in exchange for full payment. Technically, this might violate some collector’s agreements with the bureaus, but it is worth a shot. Do not forget to get that promise in written form before you make the payment. If there is any debt you do not recognize, contact the bureaus and get it removed immediately.

6.Get a Credit Card

It is important to diversify your portfolio, especially in credit. Your scores might be suffering because of the absence of a mix of different credit options. Here, you need to additionally take care of timely payments as a new credit card account with an irregular payment history will bring your score down. However, if you have a fair, good, or excellent credit score – there are many credit card options out there for you. Also Read: 8 Best Credit Cards For Online Shopping in India

7.Fix and maintain a credit utilization ratio

Start by keeping an eye on your statement balances. Your score might just be suffering if your credit card balances every month are more than 30% of your credit limits. Even if you are paying off your balances in full every month by the due date, it is being reported to the credit bureaus. In determining consumer credit, the debt-to-credit ratio is considered one of the most critical factors. Thus, it is commonly recommended to not to close any unused credit card accounts in hopes to raise your credit scores. If you do so, it will do more harm than good to your credit utilization ratio percentage. Regardless, if you plan to close a credit account, make sure you have a residual 15% utilization ratio after closing the account. If not, try to replace the credit card account with a new account or a new credit.

8.Make use of score-boosting programs

Lenders will look at both your number and the average age of your accounts whilst determining how well you handle debt. If you have a limited credit history, it can bring your score down. Many programs by the credit bureaus and other organizations allow consumers to boost a limited credit profile with other financial information. After opting for a program, you can connect your online banking data and allow the credit bureau to add utility payment history to your report. Similarly, in some programs, you can allow bureaus to consider your savings or current accounts while calculating your score.

9.Do not apply for too much credit

It is necessary to diversify your portfolio and apply for various credit options; you should be cautious about over-application as well. When you apply for credit, it creates an immediate hard inquiry on your report. These hard inquiries can bring down your credit score if done multiple times. These inquiries remain on your credit report for two years.

10.Time your applications cautiously

It is important to note that every time when you apply for a new credit, a hard inquiry is pulled on your report. This inquiry pulls down your scores temporarily. These effects can last anywhere from 6-12 months, whereas the inquiry remains on the report for a period of 24 months. Always research both the type of loan you are seeking and your probability of approval. If your application is denied, your credit score will come down immediately. Refrain from applying for several credit cards within a short time frame or before taking a loan. Bottom line: In an economy that demands more products along with increasing inflation, it becomes important to earn extra credit. A credit score can help you achieve it. You must follow these simple steps to achieve a high and improved credit score. Remember, your credit score is the only conventional criterion that will help you in taking out credit.