Bharat Microfinance Report 2017 – 2018

Demonetization, an ill-conceived act of financial terrorism failed to deter the spirit of MFI’s, entrepreneurs, and borrowers who continued to repay micro-loans albeit with minor hiccups in the repayment schedule. There was also some contraction in loan portfolio’s observed as demonetization hurt the poor the most and capital formation indicators turned negative. Going forward it is important to collect and study empirical data from the industry to ensure that microfinance companies continue to strengthen the financial inclusion agenda in India. To enable this, Sa-Dhan has released the latest version of it’s Bharat Microfinance Report 2017. The data and figures from this report can be used until September 2018 when the next version will be released.

Notable Highlights from the report are as follows:

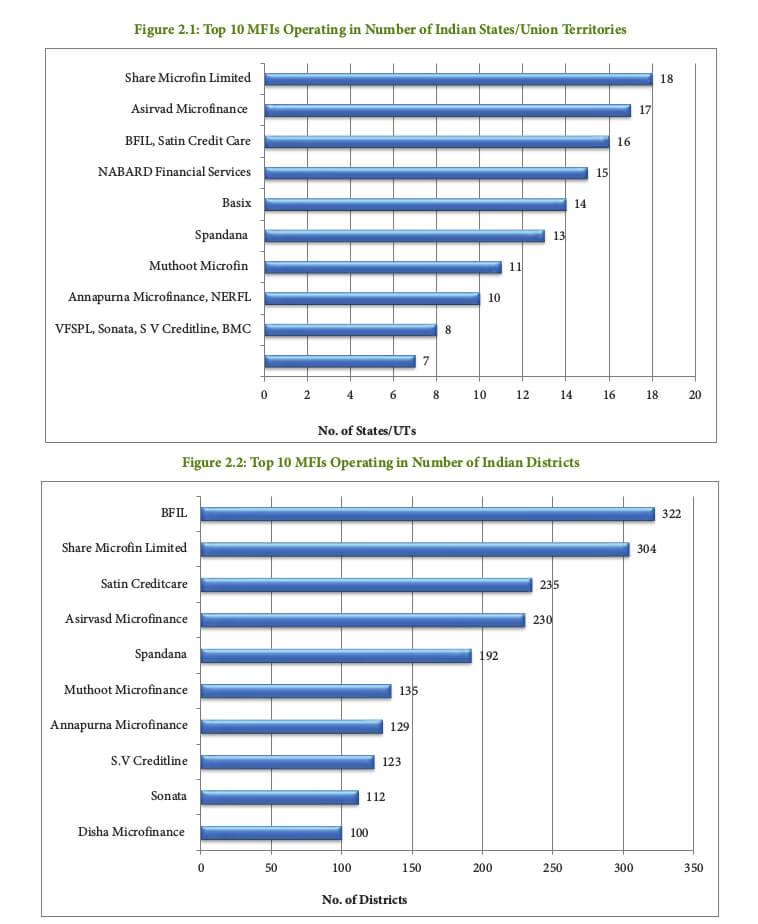

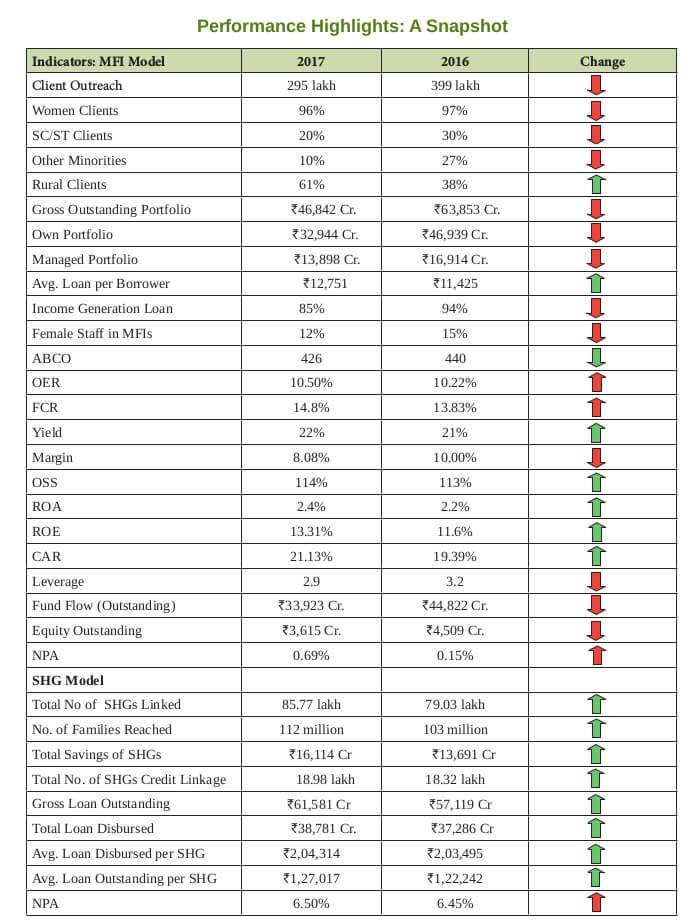

Microfinance companies have operations in 29 states, 4 UT’s and 563 districts of India. The loan outstanding for FY17 grew by 26% compared to FY16. The total outstanding loan portfolio of Indian microfinance companies stood roughly at Rs 47,000 Crores. The average loan outstanding per borrower stands at Rs 12,500. Women borrowers account for 96% of the borrowers. The microfinance sector employs close to 90,000 personnel. Field staff comprises 60% of this workforce. The proportion of urban clients has shown a decreasing trend. SC / ST borrowers constitute 20% of borrowers followed by minorities at 10% SHG’s increased during the year and the number of families linked to the SHG-BL program crossed 112 million. The loan portfolio outstanding of SHG’s stands at Rs 61,500 Crore. The NPA’s of SHG’s stand at 6.5% which is a cause for concern.

The latest version of the full report can be downloaded below: The Bharat Microfinance Report 2017 – 2018.pdf Previous versions of the report can be accessed at the links below:

Bharat Microfinance Report 2016 -2017 Bharat Microfinance Report 2015-2016