Wealth building begins with income generation – you must have a regular flow of income to save, spend and invest. Once you have established cash flow, you should look at asset management – where to invest. Personal asset management ensures the growth of wealth in the right direction by implementing a long term investment strategy that aims at balancing the risk in terms of rewards in accordance with the investor’s financial goals, risk tolerance and investment time frame. The investment strategy would require you to balance your money in a right way. How would you do that? In their book All Your Worth: The Ultimate Lifetime Money Plan, the authors Elizabeth Warren and Amelia Tyagi recommend that a balanced money formula should comprise 20% savings, 30% wants and 50% needs.

Factors to Consider for Asset Allocation

Now that you know what percentage you want to invest, the next step towards wealth building is to choose the right asset allocation. You should consider the following factors while choosing the right asset allocation for you.

1. Investment goals

You need to plan your investment based on short term and long term goals. Buy a car is a short term goal while pension income is a long term goal. The easiest way to determine your investment goals is in accordance with the key milestones of your life – buying a new house, your child’s education or marriage, elderly care and retirement.

2. Risk appetite

Risk appetite is defined as the extent to which an investor is willing to lose a part or whole of his original investment in consideration of higher returns. If you have a high-risk appetite, you would like to invest in inequities. If you have a low-risk appetite, you would like to invest in debt instruments.

3. Investment horizon

The time frame for which you want to stay invested determines the risk that you can take. A longer horizon will allow you to invest in market-linked instruments which are prone to greater volatility as compared to debt instruments. On the other hand, if you have a short term horizon, you would like to invest in more secure and safer plans like fixed deposits, public provident fund, etc. Also, if you need to withdraw money relatively soon, you may consider having a higher percentage of your investments in cash than investing in equity or fixed-income securities.

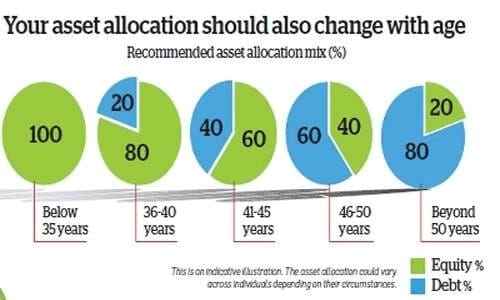

4. Age

Your age plays a very crucial role in determining the right asset allocation. What works for a 25-year-old individual may not work in the favour of a 40-year-old man. The financial outlook, number of dependents as well as income and expenses amount differ across various age brackets.

Types of Asset Allocation

There are three types of asset allocations you should choose from based on the above factors.

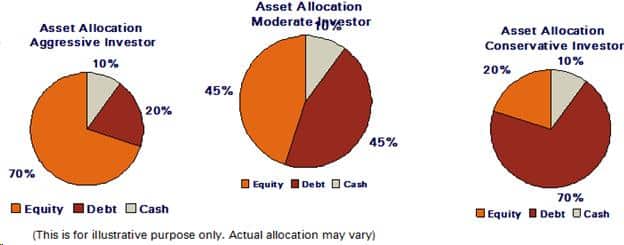

1. Aggressive Asset Allocation

This type of asset allocation is the one with around 70% investment in equities, 20% in fixed income instruments and the remaining 10% in cash or equivalents. It is suitable for those who are young, have a long term horizon or have a high-risk tolerance. This portfolio mainly focuses on growth.

2. Balanced Asset Allocation

This type of asset allocation is the one with around 45% investment in equity, 45% in debt and the remaining 10% in cash or equivalents. This portfolio is best suited for the investors in the age bracket 40 to 50 years, with a medium-term horizon or have a medium level of risk tolerance.

3. Conservative Asset Allocation

This type of asset allocation is the one around with 70% investment in debt, 20% in equity and the remaining 10% in cash or equivalents. This asset allocation is best suited for the people nearing retirement, have a short-term investment goal or have a very low-risk appetite. This portfolio mainly aims to protect the principal amount of the investment.

WEALTH BUILDING PLANS

Your wealth portfolio should be a good mix of equity and debt funds. There are various equity and debt plans available in the market. Direct equity funds, ETFs and mutual funds yield high returns but subject to high market volatility. Either you need to stay invested for the long term to even out the fluctuations or need to exit completely by paying exit load. Also, except on a few plans like Equity Linked Savings Scheme (ELSS), there are no tax exemptions in equity. Debt funds like FDs, PPF, NSC and government bonds are safer and offer tax benefits, but offer less than 10% returns currently. If you factor inflation and taxes, the returns go further lower. A unit-linked plan makes an ideal investment for wealth creation and balances your portfolio. For example, a Unit-linked Insurance Plan (ULIP). It combines the benefit of insurance and long term investment. A part of your money is invested in life cover while the remaining is allocated for the purchase of equity, debt, or balanced funds. The returns are linked to the performance of the funds, however, it is you who decides which funds to choose. This way, ULIPs give you the flexibility to decide where to invest in the market and how to maximize the return on investments. In fact, you can even switch from equity to debt or debt to equity as per your financial goals at a particular age. ULIPs offer substantial tax benefits also. Not only is the premium on ULIP investments exempted up to Rs1,50,000 under Section 80C, but the maturity and death proceeds from ULIPs are also tax-free under Section 10 (10D). Several insurance providers like ICICI Prudential offers ULIPs with a focus on wealth building. Personal asset management is the right tool to build and sustain your wealth. But, it is also important to remember that you need to review your financial goals and asset allocation from time to time to ensure you are on the right wealth building track.